两家绑带支持的公司在欧洲推出了新的欧元和美元固定稳定蛋白

时间:2025-05-29 | 作者: | 阅读:0Crypto Payment Platform Obit to Integrate Stablr's Newly Launched Eurr and USDR Tokens - Both are pegged to fiat currencies and structured in compliance with the Crypto-Assets (MICA) regulations of the European market.

As crypto exchanges continue to phase out USDT in favor of compliance with MICA regulations, two companies backed by Tether have launched new euro and dollar stablecoins in Europe.

The crypto payment app Obit will integrate Stablr's newly introduced Eurr and USDR tokens into its services. These tokens are both pegged to fiat currencies and structured in accordance with the Crypto-Assets (MICA) regulations of the European market. The stablecoins will be issued on Tether's "Real World Asset Tokenization" platform.

This move marks a strategic retreat for Tether, which was once the dominant force in the European stablecoin landscape linked to the euro. The Eurot token, which once had a $500 million market cap, withdrew after the introduction of MICA rules at the end of last year.

In a joint statement, the two companies said, "The implementation of MICA has sparked demand for compliant stablecoins in Europe." They added that this launch provides a way for Tether to maintain a foothold in the region.

Tether is not alone in adapting. Exchanges like Binance and Kraken have also started to phase out USDT across the European Economic Area due to compliance concerns.

Obit, which raised $25 million in an A-series funding round led last year, positions itself as a service for both consumers and merchants to facilitate crypto adoption. Its app will work with existing Visa and Mastercard terminals at points of sale.

Consumers using EURR or USDR for payments will receive a 5% cashback as part of the launch incentive program.

Amram Adar, CEO of Obit, said, "Integrating regulated stablecoins is a key step toward making crypto available at points of sale. We're not waiting for the future of payments; we're building it."

Stablr received an Electronic Money Institution (EMI) license from Malta's financial regulator earlier this year and was one of the first companies to deploy Tether's Bandron platform. This infrastructure supports regular reserve audits and compliance tracking, which can be used for other real-world assets such as stocks and bonds.

Following the exit of Eurot, the euro-stablecoin space has become more crowded. Circle's Eurc, Stasis' Eurs, and Société Générale's Eurcv have all made strides to vie for dominance in the expectedly growing market under stricter oversight.

Tether CEO Paolo Ardoino previously defended the company's activities in Europe, hinting last year that supporting projects like Stablr was part of a broader strategy to remain relevant in the region under new regulations.

Original image format remains unchanged.

福利游戏

相关文章

更多-

- 尼日利亚的SEC发出强有力的公共咨询警告公民不要投资持续的惩罚者硬币

- 时间:2025-06-10

-

- IT Solutions提供商长方形计划通过私人股票销售计划筹集750万美元

- 时间:2025-06-10

-

- Qubic,分散的计算和AI第1层协议,通过有用的工作证明(Upow)实现了技术突破

- 时间:2025-06-10

-

- 比特币(BTC)的价格继续显示出强度,维持水平超过$ 108,000

- 时间:2025-06-10

-

- Binance有望分享有关超流动性(HYPE)的见解,表明其天然令牌可能列表

- 时间:2025-06-09

-

- 随着美中贸易谈判的中心舞台,比特币(BTC)市场越来越高

- 时间:2025-06-09

-

- Opensea通过OS2升级再次证明了它的弹性

- 时间:2025-06-09

-

- Binance列表请参见主要上行空间,但波动率仍然存在

- 时间:2025-06-09

大家都在玩

大家都在看

更多-

- 波场杠杆与原理图解

- 时间:2025-07-08

-

- 新势力周交付量出炉:问界销冠宝座差点被零跑推翻

- 时间:2025-07-08

-

- 女子学滑翔伞 起飞十几秒突然坠落 大树救一命

- 时间:2025-07-08

-

- XRP杠杆与原理图解

- 时间:2025-07-08

-

- 小米深圳总部7月18日举行开园仪式!楼下开设全球最大小米之家

- 时间:2025-07-08

-

- REDMI K90 Pro参数曝光:安排潜望长焦 看齐大哥小米Pro系列

- 时间:2025-07-08

-

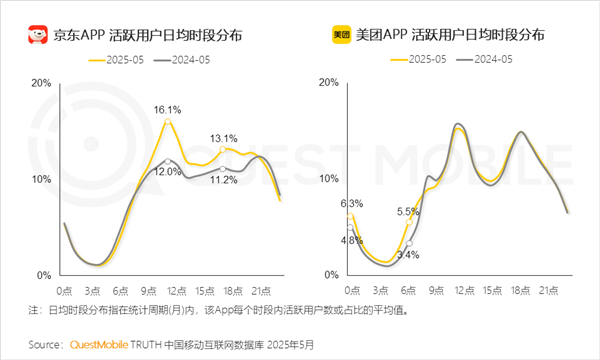

- 外卖三国杀:美团夜猫子多、京东抢午间档、淘宝靠全品类破圈

- 时间:2025-07-08

-

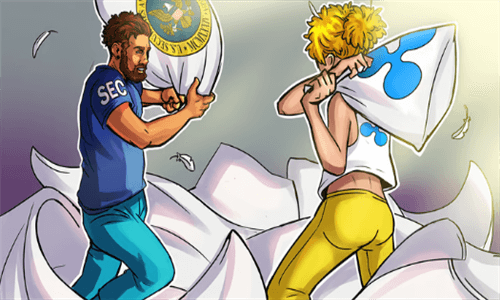

- Ripple反对SEC:罚款应限1000万,不超20亿

- 时间:2025-07-08